Debbie app review for data-driven, ROI-focused money management

If you want to convert debt payoff into a measurable ROI, the Debbie app is a noteworthy tool. In this Debbie app review, I evaluate what it does, who benefits, and how to use it alongside modern advisory workflows to improve cash flow, financial resilience, and long-term wealth creation.

Debbie app features, debt management tools, and how to get rewarded for paying off debt

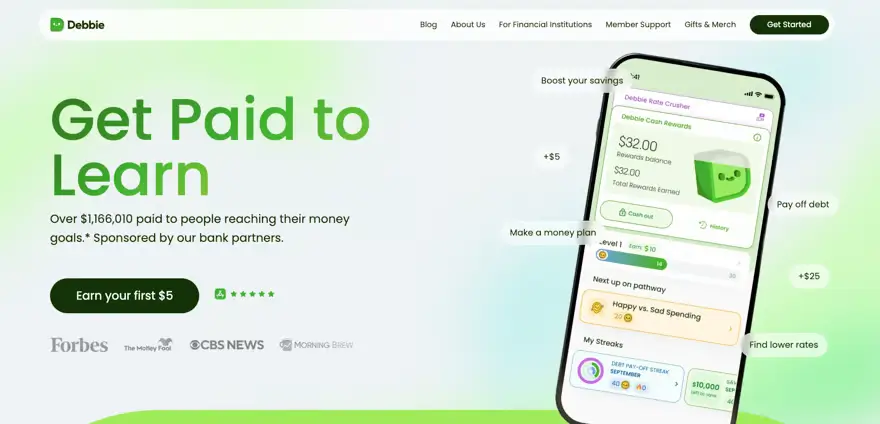

Debbie is a fintech app for debt payoff that gamifies good money behavior and offers cash rewards for debt payoff. Think of it as a “behavioral finance layer” sitting on top of your bank and credit accounts, nudging you to reduce balances faster and build savings habits—then recognizing your progress with tangible incentives.

What the Debbie rewards app typically includes:

- Debt payoff tracking: Aggregate credit accounts, set a payoff plan, and track progress toward debt-free milestones.

- Saving milestones rewards: Earn perks for hitting milestones (e.g., on-time payments, consecutive months of reduced balances, or savings contributions).

- Financial reward apps approach: Small cash rewards, gift cards, or partner offers for staying on plan.

- Behavioral nudges: Habit loops, streaks, reminders, and progress dashboards that make momentum visible.

- Debt management tools: Payment scheduling guidance, payoff strategy calculators (snowball vs. avalanche), and spending analysis to free up cash flow.

How it fits real life:

- Students: Use Debbie to structure a strategy for paying down a first credit card while building a starter emergency fund. Rewards provide dopamine to stay engaged.

- Mid-career professionals: Prioritize high-interest cards while integrating auto-transfers to savings. Tie Debbie milestones to bonus income months.

- Retirees: Use Debbie to simplify and monitor the glidepath from high-cost consumer debt to a lower fixed cost base, supporting distribution planning and lowering sequence-of-returns risk.

Capitalist principle at play: incentives drive behavior. If an app pays you—literally or via perks—for consistently reducing principal, you accelerate cash-flow liberation. That liberated cash can then be redeployed into investments with higher expected returns, improving your lifetime after-tax net worth.

How Debbie compares to financial reward apps and fintech app for debt payoff options

Financial reward apps come in several flavors. Debbie is squarely in the “get rewarded for paying off debt” category; it isn’t an investing platform. Here’s a practical comparison for clarity:

Comparison snapshot

- Goal:

- Debbie: Accelerate debt payoff via rewards and behavior design.

- Acorns/Stash: Micro-investing, portfolio building, and automated saving; not focused on debt payoff rewards.

- Debt payoff planners (various apps): Track balances and provide payoff strategies; few offer cash incentives.

- Primary ROI Lever:

- Debbie: Interest saved + rewards earned for payoff behavior.

- Acorns/Stash: Compounding investment returns (market risk).

- Debt planners: Interest saved via better strategy and consistency.

- Who should use which?

- Heavy/high-APR debt users: Start with Debbie or a dedicated debt management tool to aggressively reduce interest drag.

- Low/no high-interest debt + surplus cash flow: Prioritize investing apps for long-term compounding.

- Hybrid users: Run a dual-track plan—Debbie for high APR debt, and small automated investing (e.g., Roth IRA contributions) to keep compounding alive.

Advisor’s take: You don’t need to choose only one. In practice, we often layer these solutions:

- Use Debbie to eliminate 20% APR debt quickly.

- Direct the monthly savings into retirement accounts and diversified ETFs.

- Use an analytics layer to measure delta in net worth growth rate pre/post-debt payoff.

Cash rewards for debt payoff: where the value really comes from

Let’s be candid: even if rewards are modest, the dominant driver of ROI is interest avoided. If you knock out a card at 24.99% APR, every extra $100 you apply is like “earning” an after-tax 24.99% return on capital that month (ignoring compounding nuances). Debbie’s value-add is that it motivates consistent action and tracks milestones—turning your payoff plan into a series of winnable sprints.

Quick math example:

- Balance: $7,000 at 24% APR, minimum payment 2% (~$140).

- Pay an extra $260/month (total $400).

- Interest saved over 12 months can exceed hundreds of dollars versus minimum-only behavior. Add even small rewards and the effective ROI improves further.

Behavior tech matters because it closes the intention-action gap. As an advisor, I’d rather see a client use an app that keeps them engaged than rely on spreadsheets they never open.

Debbie app features that matter to pros: analytics, automation, and habit design

If you’re optimizing your financial stack, these Debbie features tend to deliver outsized impact:

- Clear, visual debt payoff tracking that reinforces streaks and progress.

- Structured challenges and saving milestones rewards to maintain momentum.

- Risk alerts for spending spikes that threaten your payoff plan.

- Integration with bank and card accounts for real-time feedback.

- Recommendations for payoff strategies (avalanche vs. snowball), informed by your balances and APRs.

Advisor workflow alignment:

- Onboarding: Pull in liabilities data to build a shared plan.

- Review cadence: Monthly check-ins on payoff velocity and budget drift.

- Automation: Auto-allocate surplus to debt and savings checkpoints.

- Reporting: Quantify interest saved, time-to-debt-free, and reward value realized.

Step-by-step playbook: how to get rewarded for paying off debt with Debbie

- Inventory your debt:

- List all credit cards, personal loans, and retail cards with balances, APRs, and minimums.

- Pick a payoff strategy:

- Avalanche (highest APR first) maximizes ROI.

- Snowball (smallest balance first) maximizes motivation; Debbie’s rewards can amplify this momentum.

- Build a micro emergency fund:

- Target $500–$1,500 to reduce the odds you re-borrow. Debbie’s saving milestones rewards can reinforce this.

- Install Debbie and connect accounts:

- Enable notifications. Embrace the behavioral nudges—they work.

- Automate payments:

- Minimums for all accounts, plus targeted extra payment to your current priority debt.

- Use the app’s challenges:

- Aim for streaks and milestones. Small wins + rewards create compounding motivation.

- Redirect freed-up cash:

- As each debt is closed, immediately increase contributions to Roth IRA, 401(k), HSA, or a taxable brokerage. Time in the market matters.

- Track the ROI:

- Measure interest saved, time saved to debt-free, and net worth growth rate after redeploying cash flow.

Debt payoff tracking meets portfolio management: sequencing for maximum ROI

What pros often miss: the sequencing of paying down debt and investing can be optimized.

Advisor framework:

- High-interest debt (≥12% APR): Prioritize payoff. This risk-free “return” usually beats expected market returns after tax.

- Employer 401(k) match: Don’t leave free money on the table; contribute at least to the match even during aggressive payoff.

- Tax-advantaged accounts: As debt load declines, ramp contributions to IRAs/HSA for tax alpha.

- Liquidity buffer: Keep 3–6 months of expenses after high-interest debt is cleared to defend against re-leverage.

Automation tip:

- Use rules-based transfers: “If checking balance > $X on payday + 3 days, move surplus to priority debt or savings.” Debbie can complement this with behavioral reinforcement.

Financial data analysis and automated risk assessment using modern tools

How tech improves outcomes:

- AI-driven categorization detects spending creep that undermines payoff velocity.

- Automated risk assessment flags debt utilization spikes (e.g., crossing 30% utilization ratio), which can affect credit score and interest costs.

- Investment forecasting can simulate: “Debt-free in 10 months” vs. “Minimum payments for 36 months.” The difference in lifetime portfolio value is often six figures over decades.

Practical example:

- A 28-year-old pays off $9,000 at 23% APR in 12 months instead of 36 months, then invests $300/month for the next 24 months at a 7% expected return. The compounding jumpstart vs. delaying investing can materially change their retirement glidepath, even after accounting for market volatility.

For students, professionals, and retirees: tailored applications

- Students:

- Use Debbie to destroy your first high-interest card fast, build a $1,000 buffer, and start a Roth IRA with even $25/month. You’re buying decades of compounding.

- Working professionals:

- Consolidate if it lowers APR without extending total interest paid. Layer Debbie to maintain discipline and earn rewards while you redirect cash toward tax-advantaged investing.

- Retirees:

- Reduce fixed costs by retiring high-APR debt, improving withdrawal rate tolerance. Debbie’s tracking and milestones help ensure adherence without micromanaging.

Is Debbie better than a basic spreadsheet?

Spreadsheets are powerful for planning; Debbie is powerful for execution. Humans are not spreadsheets. The behavioral layer—nudges, streaks, rewards—often drives materially different results, especially during stressful months. If you already execute perfectly without reminders, you may not need a rewards app. Most of us benefit from systems that remove friction.

How Debbie might monetize and why it matters

Most free fintechs monetize via some combination of:

- Bank/credit union partnerships

- Referral fees for financial products (e.g., consolidation loans, savings accounts)

- Premium tiers or optional paid features

- Interchange revenue on debit/spend products (if offered)

As an advisor, I prefer transparent monetization that doesn’t push consumers into higher-cost products. If Debbie refers you to a partner product, compare APRs, fees, and terms to independent market options before acting.

Security, privacy, and data governance expectations

Any app that connects to financial accounts should provide:

- Bank-level encryption and secure data aggregation via vetted providers

- Read-only connections where possible

- Clear data-use policies with opt-out for marketing sharing

- MFA and device-level security

Security is table stakes. Verify current policies inside the app and on the company’s site before connecting accounts.

A quick comparison table: Debbie vs. Acorns vs. Stash vs. traditional debt trackers

Note: This is a general comparison; always verify current features and fees.

- Primary purpose:

- Debbie: Reward-driven debt payoff tracking

- Acorns: Automated micro-investing and round-ups

- Stash: Guided investing with fractional shares; budgeting features

- Traditional Debt Trackers: Planning and monitoring without rewards

- Monetization:

- Debbie: Typically free; may monetize via partners/referrals

- Acorns/Stash: Subscription tiers

- Trackers: Free or low-cost premium versions

- Best for:

- Debbie: Users with high-interest debt seeking motivation + measurable ROI from interest saved

- Acorns/Stash: Users ready to invest consistently

- Trackers: DIY planners who don’t need behavioral reinforcement

Advisor checklist: using Debbie inside a modern planning stack

- Intake: Connect liabilities in a secure planning portal; confirm balances/APRs match Debbie.

- Targets: Define 30-, 90-, and 180-day payoff milestones.

- Automation: Align payment dates with income cycles; enable Debbie notifications.

- Oversight: Monthly KPI review—interest saved, utilization ratio, streak days, emergency fund level.

- Transition plan: Pre-set a directive: “When Card A is paid off, auto-increase Roth/401(k) by $X.”

- Guardrails: Caps on discretionary categories during payoff sprints; revisit quarterly.

FAQ Section

Q: What is the Debbie app?

A: Debbie is a fintech app for debt payoff that uses behavioral science, debt payoff tracking, and small rewards to keep you engaged as you eliminate high-interest balances and build savings habits.

Q: Is Debbie app free to use?

Q: Is Debbie app free to use? A: Debbie has been positioned as free for core features, with monetization often coming from partner relationships or referrals. Always check current pricing and terms in the app store listing and within the app.

Q: How does Debbie app reward users for paying off debt?

A: Users typically earn small cash rewards or perks for hitting milestones—such as consecutive on-time payments, balance reductions, or savings milestones. The goal is to reinforce consistent, high-ROI behavior.

Q: How secure is the Debbie app?

A: Expect bank-level encryption, secure data aggregation, and MFA options. Review the app’s security documentation and privacy policy before connecting accounts, and enable device-level protections.

Q: How does Debbie make money if it’s free?

A: Common models include partner referrals (e.g., banks, credit unions, consolidation loans), optional premium features, or financial product partnerships. Evaluate any recommended products independently.

Q: Can I use Debbie on Android and iOS?

A: Debbie availability has included both iOS and Android in many rollouts, but app store availability can change. Search “Debbie rewards app” in the Apple App Store and Google Play to confirm.

Q: Does Debbie offer customer service?

A: Yes, typically via in-app chat, email, or help center resources. Look for support links in settings and review response times in recent app store reviews.

Q: Do I need a partner credit union account for Debbie?

Q: Do I need a partner credit union account for Debbie? A: Generally, no. You can link your existing bank and credit accounts for tracking. Some rewards or offers may be tied to partners, but using Debbie shouldn’t require switching banks unless you opt in.

Q: How does Debbie compare to apps like Acorns or Stash?

A: Debbie is a debt payoff and behavioral rewards tool, while Acorns and Stash are investing platforms. If you carry high-APR debt, Debbie helps you eliminate drag first; then you can funnel freed cash into Acorns/Stash or a brokerage for long-term growth.

Q: Is it worth using the Debbie app?

A: If you have high-interest debt and benefit from nudges and measurable milestones, Debbie can be worth it—especially when rewards boost motivation. For disciplined users already executing a payoff plan flawlessly, Debbie is optional but can still provide visibility and momentum.

Conclusion

Debt payoff is not just about discipline—it’s about systems and incentives. The Debbie app turns payoff into a series of rewarded sprints, boosts adherence with behavioral design, and provides real-time feedback that many spreadsheets can’t. For students, it’s a launchpad to positive cash flow and early investing. For professionals, it’s a lever to accelerate net worth compounding by reallocating interest savings into tax-optimized investments. For retirees, it’s a way to reduce fixed costs and lower retirement distribution risk.

Adopt technology that pays you back. Test Debbie for 90 days, measure interest saved and milestones achieved, and then redirect the freed cash into your highest-ROI investment vehicles. That is how you convert today’s dollars into tomorrow’s financial independence.

References

- Debbie Review on The College Investor: https://thecollegeinvestor.com/66027/debbie-review/

- SEC proposal to end quarterly earnings: What it means for investors and markets

- Student Loan Forgiveness Lawsuit: What the AFT Case Means for IDR, PSLF, and Taxes

- PSLF Weighted Average Rule: The Smart Advisor’s Guide to Consolidation and Forgiveness

- Business Credit Building Services: A Data-Driven Playbook for Entrepreneurs

- Tello Mobile Plan Review: A No-Contract, Budget MVNO That Can Boost Your Cash Flow