College Acceptance Rates and Your Financial Strategy

College acceptance rates aren’t just an education headline—they’re a financial planning variable with real cash flow consequences. As a finance advisor who blends human judgment with data science, I’ll unpack what decreasing college acceptance rates mean for cost, ROI, risk management, and family balance sheets. Whether you’re a student, a mid-career investor-parent, or a retiree funding grandkids, understanding admissions dynamics is now part of smart wealth strategy.

Decreasing college acceptance rates, college admissions trends, NACAC college statistics, college enrollment trends, college admissions competition

College admissions have shifted from a predictable process to a high-volatility market. The “price” of admission—measured in probability, effort, and opportunity cost—has changed due to demand, policy, and technology. Here’s how I evaluate the landscape, drawing from public data sources (like NACAC college statistics, federal College Scorecard, and school-reported dashboards) and my advisory analytics stack.

- Why acceptance rates are falling (the macro)

- Demand dynamics: More applicants are chasing the same or only modestly increasing seats. Population cohorts shift by region, but selective colleges still attract outsized demand nationwide.

- Application friction falls: The Common App and low-cost fee structures reduce marginal cost per application. Students apply to 10–20+ schools, not 3–5, expanding total application volume.

- Policy shifts: Test-optional colleges broaden the funnel; more students feel qualified to apply. In many cycles, this boosts application counts faster than capacity expands, leading to decreasing college acceptance rates.

- Brand concentration: College admissions competition concentrates at the top, where prestige signals are strongest and international demand is robust.

- Yield uncertainty: Schools struggle to predict who will enroll (yield). To protect incoming class sizes, they admit fewer students initially, then lean more on college waitlists. The result: more volatility per student and lower headline acceptance rates.

- What NACAC and sector data indicate (the micro)

- Application inflation: NACAC and school reports have documented significant multi-year increases in applications per student. That doesn’t always correlate with higher enrollment, however.

- Enrollment trends: Regional publics and less-selective privates may face headwinds (demographics, price sensitivity), while selective colleges enjoy a wide demand moat. This bifurcation is a hallmark of a competitive, free-market system.

- Selectivity barbell: Highly selective colleges become more selective; some non-flagship institutions compete harder on merit aid, program innovation, and speed-to-career outcomes.

- Financial implications: Strategy over stress

- Cash flow volatility: Uncertain outcomes force families to build larger application portfolios (more fees, test prep, travel), creating short-term cost spikes.

- Aid arbitrage opportunity: Merit and need-based packages can vary widely. That’s an opportunity for disciplined, data-driven shoppers, akin to value investing across a fragmented market.

- Timing risk: Delayed clarity (waitlists) can compress decision timelines for deposits, housing, and loan applications. Liquidity planning matters.

- Advisor playbook: Model college like an investment I treat each potential college like a long-duration asset with upfront cost and variable cash flow. We forecast:

- Total cost of attendance (TCOA): Tuition, fees, housing, travel, inflation assumptions.

- Adjusted net price: After projected merit/need aid, 529 drawdowns, and tax credits (AOTC, Lifetime Learning Credit).

- Earnings delta (IRR proxy): Use College Scorecard program-level earnings, location-adjusted salaries, and debt terms to estimate the return on education (ROE).

- Risk factors: Major persistence (likelihood to complete), transfer risk, time-to-degree, and labor market alignment.

- Scenario testing: If acceptance probabilities drop at reach schools, what’s the expected value of the overall application portfolio? How do we reweight targets and safeties?

- Tools we use (Tech-forward)

- Data: College Scorecard, IPEDS, NACAC updates, Common Data Set disclosures, school financial aid pages.

- Analytics: Monte Carlo simulations of acceptance and aid outcomes; multi-scenario 529 spending models; after-tax aid optimization.

- Automation: Scholarship search automations, document collection workflows for the FAFSA and CSS Profile, reminder bots for deadlines.

- AI: Summary agents to parse admissions pages and aid policies; predictive models to approximate acceptance odds by profile bands; NLP tools to compare program outcomes.

Takeaway: Decreasing college acceptance rates are a signal to manage risk, diversify applications, and quantify ROI. The market is competitive—but competition rewards the informed and prepared.

Top schools acceptance rates, test-optional colleges, college waitlists, selective colleges, college application process Section 2

Let’s drill into the mechanics at the most selective colleges and translate them into actionable financial decisions.

- Top schools acceptance rates and selectivity

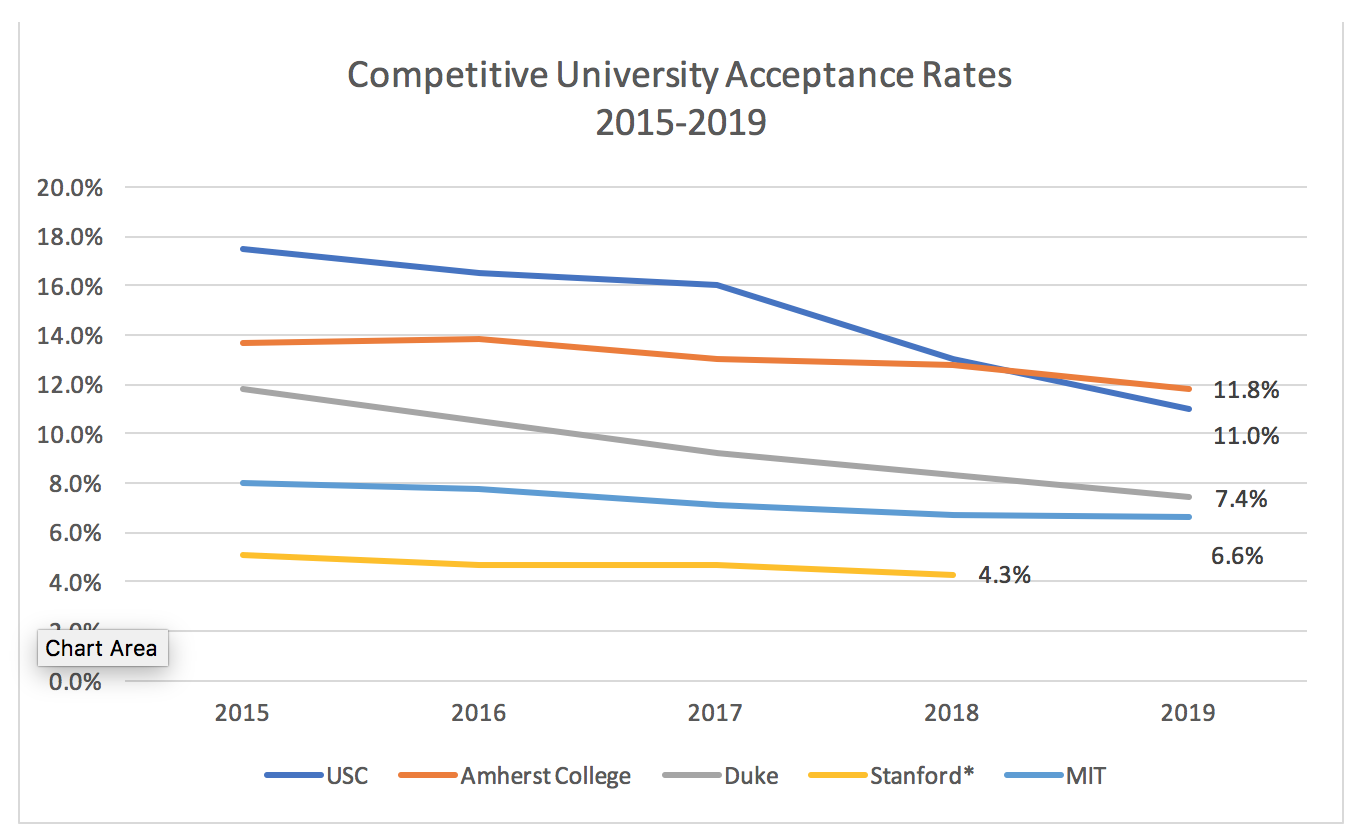

- Expect low single-digit to teens acceptance at the most selective colleges, varying by program, residency, and applicant profile.

- Top schools acceptance rates fluctuate yearly with yield expectations, institutional priorities (e.g., STEM capacity), and fundraising/alumni dynamics.

- Practical takeaway: Never hinge your financial plan on a single reach admit. That’s concentration risk.

- Test-optional colleges: What it means for your wallet

- Access expands, competition rises: Test-optional policies can raise applicant volume, compress predictability, and thus reduce headline acceptance rates.

- Merit aid nuance: Some colleges still use scores to award top merit. Submitting a strong score can improve both odds and dollars.

- Strategy: Run A/B scenarios—submit scores where they add value, omit where they don’t. Use the school’s Common Data Set to gauge where your score sits relative to enrolled students.

- College waitlists: How they work, financially

- Waitlist is not a soft reject; it’s a reserve bench for yield management. Students may get admitted late spring or summer.

- Financial planning must account for:

- Holding deposit at another school (opportunity cost)

- Housing and travel flexibility

- Aid uncertainty (some colleges allocate less aid to late admits; others may still negotiate)

- Strategy: Keep liquidity for deposits and travel; maintain documentation to appeal or update the school with achievements. Negotiate respectfully and factually.

- College application process as a capital allocation exercise Treat each application like a micro-investment:

- Define objective: ROI target (earnings-to-debt ratio), career pathway, geography.

- Portfolio construction:

- Reach (10–25% probability)

- Competitive/target (30–60%)

- Foundation/safety (70%+)

- Rebalancing: If early outcomes change odds, adjust Regular Decision mix or consider rolling admissions to lock in backup options at acceptable net prices.

- Risk controls:

- Cap total application spend (fees + prep + travel)

- Prioritize programs with strong co-ops/internships (cash flow offsets via paid work)

- Consider honors colleges at state universities for elite academics at lower cost

- Advisor workflow: From FAFSA to IRR

- FAFSA/SAI planning: The Student Aid Index (SAI) has replaced the EFC. We model how asset location (529, taxable accounts, student assets) and timing affect aid eligibility. We coordinate with CPAs to optimize above-the-line deductions, QTP distributions, and timing of capital gains.

- 529 plan optimization:

- Front-load contributions if cash flow allows; leverage state tax deductions/credits where applicable.

- Asset allocation by horizon: Glide path more conservative as matriculation nears, but maintain growth exposure for multi-year tuition.

- Qualified expenses coordination: Time distributions with billing to avoid tax issues; track room/board rules if off-campus.

- Debt strategy:

- Evaluate federal vs. private loans, interest rate environment, and repayment protections.

- Project Payment-to-Income ratio under different career outcomes.

- If parents consider PLUS loans, stress-test retirement plan impact first.

- Negotiation framework:

- Compare competing award letters on a normalized basis (grant vs. loan vs. work-study).

- Use data: If peer schools (same selectivity) offer better grants, present facts to the financial aid office.

- Document changes in circumstance (job loss, medical costs) with clear, respectful appeals.

- Technology stack for families and advisors

- Planning: College funding modules integrated into financial planning software; custom APIs to pull College Scorecard/program earnings.

- Forecasting: Scenario tools to model 4–5 year net price with tuition inflation; simulate merit ranges.

- Automation: Deadline dashboards, digital vaults for forms, scholarship email filters with AI summaries.

- Risk analytics: Monte Carlo acceptance/aid outcomes; sensitivity analysis on majors and regional salary data.

- Case studies across life stages

- Student (18–22): A first-gen student uses a test-optional strategy, submits a strong math SAT to STEM targets only, and leverages co-op programs. Net price drops 25% via merit and subsidized loans. Internship income reduces borrowing by $6–10k per year. ROI improves with earlier workforce entry.

- Professional parent (35–55): Family with two kids staggers 529 withdrawals to maximize AOTC across four tax years, keeps AGI under phaseouts, and structures capital gains harvesting pre-FAFSA to minimize SAI spikes. Appeals yield an extra $8k grant at a competitive private.

- Retiree/grandparent (60+): Grandparents gift through 529s strategically, coordinating ownership to avoid unintended aid impacts; they use superfunding (gift-tax annual exclusion/lifetime exemption awareness) and maintain portfolio withdrawal discipline to protect retirement while supporting legacy goals.

- Alternatives that protect ROI

- Honors colleges at public universities

- 3-year degree tracks or AP/IB credit acceleration

- Co-ops and apprenticeships that pay during study

- Community college + transfer pathways (2+2), with articulation agreements that ensure credit transfer

- Online or hybrid programs with strong employer partnerships

- Measuring ROI like an investor

- Inputs: Net price, debt terms, completion probability, time-to-degree

- Outputs: Median earnings at 1, 5, and 10 years for the specific major; location cost-of-living adjustment

- KPIs: Debt-to-income at graduation, payback period, IRR of the education investment

- Rule of thumb: Keep total undergraduate borrowing roughly at or below the graduate’s projected first-year salary in the intended field. Adjust for high-variability fields.

- Action checklist for this admissions cycle

- Build a barbelled college list: 3–5 targets, 2–4 safeties with auto-merit potential, 1–3 reaches

- Use each school’s Net Price Calculator and run sensitivity tests

- Decide score submission strategy school-by-school using Common Data Set bands

- Apply early to at least one affordable safety to lock an option

- Prepare a documented financial aid appeal playbook

- Keep liquidity for deposits and waitlist contingencies

- Integrate college cash flows into your broader investment plan

FAQ Section

Q: Why are college acceptance rates dropping?

A: Application volume has outpaced capacity at many institutions. Test-optional policies, easier application tools, and brand concentration drive more applicants to selective colleges. Schools also manage yield uncertainty by admitting fewer upfront and using waitlists, which lowers headline acceptance rates.

Q: How do declining college acceptance rates affect students?

A: They create more volatility. Students submit more applications, face longer timelines, and may see more waitlist outcomes. Financially, this means higher application costs, uncertainty around aid, and compressed decision windows. The solution is portfolio-style planning: diversify your list, secure at least one affordable admit early, and model net price scenarios.

Q: What is the impact of test-optional policies on college acceptance rates?

A: Test-optional policies tend to increase applications, especially from students who might not have applied under test-required rules. This can reduce acceptance rates at selective schools. For merit money, strong scores still help at many colleges—submit where your score is above the school’s median; consider omitting where it doesn’t add value.

Q: How do waitlists work in college admissions?

Q: How do waitlists work in college admissions? A: Waitlists are yield management tools. Schools extend offers to waitlisted students when accepted students decline and capacity remains. Offers can arrive late spring or summer. Financially, plan for dual tracks: hold a deposit elsewhere, keep travel and housing flexible, and ask the financial aid office how aid may differ for waitlist admits.

Q: What schools have the lowest acceptance rates?

A: The most selective colleges and specialized programs—often elite private universities and certain public honors/STEM programs—tend to post the lowest acceptance rates. Check each school’s Common Data Set and admissions dashboard for current figures, as they can change annually.

Q: How can students improve their chances of getting into selective colleges? A:

Academics: Optimize GPA rigor; submit test scores where they help.

Positioning: Demonstrate depth in a spike area (research, entrepreneurship, competition awards).

Timing: Apply Early Decision/Early Action strategically if affordable; run net price calculators first.

Fit: Align essays and recommendations with each school’s mission and program strengths.

Financial: Use merit-targeting—apply to schools that historically award grants to your profile. Secure at least one affordable admit early to reduce stress and maintain leverage.

Conclusion

In a market defined by decreasing college acceptance rates and rising competition, the winners aren’t necessarily the loudest or the luckiest—they’re the most prepared and data-driven. Treat admissions like an investment decision: diversify intelligently, quantify ROI, and use technology to compress uncertainty. Whether you’re a student building your future cash flows, a professional optimizing family capital, or a retiree shaping legacy, the free market rewards clarity, discipline, and speed.

Adopt a tech-enabled playbook: run net price simulations, analyze program-level outcomes, automate deadlines, and negotiate aid with facts. If you want an advisor who merges human judgment with AI analytics to map your admissions, funding, and investment strategy end-to-end, let’s build your plan—so your education dollars compound, not erode.

References

- Why are college acceptance rates decreasing? https://thecollegeinvestor.com/44292/why-are-college-acceptance-rates-decreasing/

- SEC proposal to end quarterly earnings: What it means for investors and markets

- Student Loan Forgiveness Lawsuit: What the AFT Case Means for IDR, PSLF, and Taxes

- PSLF Weighted Average Rule: The Smart Advisor’s Guide to Consolidation and Forgiveness

- Business Credit Building Services: A Data-Driven Playbook for Entrepreneurs

- Tello Mobile Plan Review: A No-Contract, Budget MVNO That Can Boost Your Cash Flow