The Best 529 Plan Alternatives for Smarter College Savings

College costs keep rising, and while 529 plans are popular, they’re not your only option. Whether you’re a parent starting early, a student planning ahead, or someone wondering “why 529 plans are a bad idea” for your situation, this guide covers the best 529 plan alternatives that might work better for your family’s needs.

Saving for college is a big deal — and relying only on a 529 plan isn’t always the best choice. In fact, many families now look for the best 529 plan alternatives for smarter college savings. In this article, we’ll explain easy‑to-understand options and compare them side by side.

You’ll also see terms like “Best 529 plan alternatives Reddit” (many real people ask about this), “Best 529 plans by state,” “Why 529 plans are a bad idea,” “Best 529 plans NerdWallet,” and “The pros and cons of four alternatives to 529 plans for college.” Let’s make sense of all that — for beginners and non‑experts alike.

Why Consider 529 Plan Alternatives? Why Look Beyond 529 Plans?

529 plans are popular, and for good reason: they offer tax benefits and are designed for education. But they aren’t perfect. Some drawbacks include:

- Limited flexibility: If your child doesn’t attend college, using the money can trigger taxes and penalties.

- Restricted investments: Many plans limit what funds you can invest in.

- Impact on financial aid: Though 529s often have favorable treatment, they can still influence aid eligibility.

- State rules vary: What’s “best” in one state may be weak in another. (That’s why reviewers list best 529 plans by state.)

Because of these issues, you should consider alternatives. Many personal finance forums and Reddit threads also debate “best 529 plan alternatives Reddit”, showing there’s real demand for alternate ideas.

Now, let’s explore the top 529 plan alternatives in a clear, side-by-side way.

The 6 Best 529 Plan Alternatives for College Savings | The pros and cons of four alternatives to 529 plans for college

1. UGMA and UTMA Accounts: Maximum Investment Flexibility

What they are: Custodial accounts where an adult manages investments for a child until they reach adulthood (typically 18-21).

How they work:

- You can invest in stocks, bonds, ETFs, or almost any investment

- The child owns the assets, but you control them until they’re an adult

- No contribution limits (unlike the $2,000 Coverdell limit)

- Money can be used for any purpose that benefits the child

Pros:

- Complete investment freedom

- No restrictions on how money is used

- Can be used for education at any level

- Higher potential returns than savings bonds

Cons:

- Counted as student assets (reduces financial aid by up to 20%)

- Child gains full control at adulthood

- Higher tax implications than 529s

Best for: Families who want investment flexibility and aren’t worried about financial aid impact.

2. Roth IRA: The Double-Duty Savings Account

What it is: A retirement account that can also fund education expenses under specific rules.

How it works for education:

- Contribute up to $7,000 annually (2024 limits)

- Contributions can be withdrawn anytime, tax-free

- Earnings can be withdrawn penalty-free for qualified education expenses after 5 years

- If not used for education, it continues growing for retirement

Pros:

- Dual purpose: retirement and education

- Tax-free growth and withdrawals

- Not counted in financial aid calculations

- You keep control of the money

Cons:

- Lower contribution limits than 529s

- Income limits may restrict eligibility

- 5-year waiting period for earnings withdrawals

Best for: Parents who want to save for education but don’t want to sacrifice retirement planning.

3. Coverdell Education Savings Account (ESA): The Flexible Education Account

What it is: A tax-advantaged account specifically designed for education expenses from kindergarten through college.

Key features:

- $2,000 annual contribution limit per child

- Tax-free growth and withdrawals for qualified expenses

- Can be used for K-12 and college expenses

- More investment options than most 529 plans

- Must be used by age 30 or transferred to family member

Pros:

- Covers all education levels (K-12 and college)

- Broad investment choices

- Tax-free withdrawals for education

- Can pay for computers, internet, and educational software

Cons:

- Low contribution limits

- Income limits for contributors

- Must be used by age 30

Best for: Families wanting to save for K-12 private school and college, especially those who want more investment control.

4. Permanent Life Insurance: The Unexpected College Savings Tool

What it is: Whole life or universal life insurance policies that build cash value over time.

How it works for education:

- Pay premiums that build cash value

- Borrow against cash value for college expenses

- Death benefit protects family’s financial future

- Loans don’t have to be repaid (but reduce death benefit)

Pros:

- Tax-free loans against cash value

- Not counted for financial aid

- Provides life insurance protection

- No restrictions on fund usage

Cons:

- High fees and costs

- Low returns compared to market investments

- Complex products requiring careful selection

- Takes years to build meaningful cash value

Best for: High-income families who’ve maximized other options and want life insurance protection.

5. Savings Bonds: The Ultra-Safe Choice

What they are: U.S. government-backed bonds that earn interest over time.

Series EE and I Bonds for education:

- Purchase at face value (Series I) or 50% of face value (Series EE)

- Interest may be tax-free when used for qualified education expenses

- Must meet income requirements for tax-free treatment

- Guaranteed by U.S. government

Pros:

- No risk of losing money

- Potential tax-free interest for education

- Easy to purchase and manage

- No fees or expenses

Cons:

- Low returns (currently around 2-5% annually)

- Annual purchase limits ($10,000 for I Bonds, $10,000 for EE Bonds)

- Inflation may erode purchasing power

- Income limits for tax benefits

Best for: Very conservative investors who prioritize capital preservation over growth.

6. Regular Taxable Investment Accounts: The Ultimate Flexibility Option

What it is: Standard brokerage account with no restrictions on contributions, investments, or withdrawals.

Key features:

- No contribution limits

- Complete investment freedom

- Money can be used for anything

- You maintain full control

- Taxable gains and dividends

Pros:

- Maximum flexibility in investments and usage

- No penalties for non-education use

- Can access money anytime for any reason

- May qualify for favorable capital gains tax rates

Cons:

- No special tax advantages

- Counted as parent asset for financial aid (5.64% assessment rate)

- Must pay taxes on gains and dividends

Best for: Families who want maximum flexibility and aren’t concerned about losing education-specific tax benefits.

Comparing 529 Plans vs. Alternatives: Quick Reference

| Account Type | Tax Benefits | Flexibility | Financial Aid Impact | Best Use Case |

|---|---|---|---|---|

| 529 Plan | Tax-free growth & withdrawals | Education only | Parent asset (5.64%) | Traditional college savings |

| UGMA/UTMA | Minimal | Any child benefit | Student asset (20%) | Investment flexibility |

| Roth IRA | Tax-free | Education or retirement | Not counted | Dual-purpose planning |

| Coverdell ESA | Tax-free for education | K-12 and college | Parent asset (5.64%) | All education levels |

| Life Insurance | Tax-free loans | Any purpose | Not counted | High-income families |

| Savings Bonds | Potentially tax-free | Any purpose | Parent asset (5.64%) | Conservative investors |

| Taxable Account | None | Any purpose | Parent asset (5.64%) | Maximum flexibility |

How to Choose the Best 529 Plan Alternative for Your Family

Step 1: Assess Your Priorities

- Flexibility: How important is it to use money for non-education expenses?

- Control: Do you want to maintain control, or are you comfortable with the child eventually controlling the funds?

- Financial aid: Will you likely qualify for need-based aid?

- Risk tolerance: Are you comfortable with market volatility for potentially higher returns?

Step 2: Consider Your Timeline

- Starting early (child under 10): More time for growth allows for higher-risk investments

- Starting late (child over 14): May need more conservative approaches

- Multiple children: Consider accounts that can benefit siblings

Step 3: Evaluate Your Financial Situation

- High income: May benefit from tax-advantaged accounts or life insurance strategies

- Moderate income: Focus on accounts that don’t heavily impact financial aid

- Lower income: Prioritize accounts that preserve aid eligibility

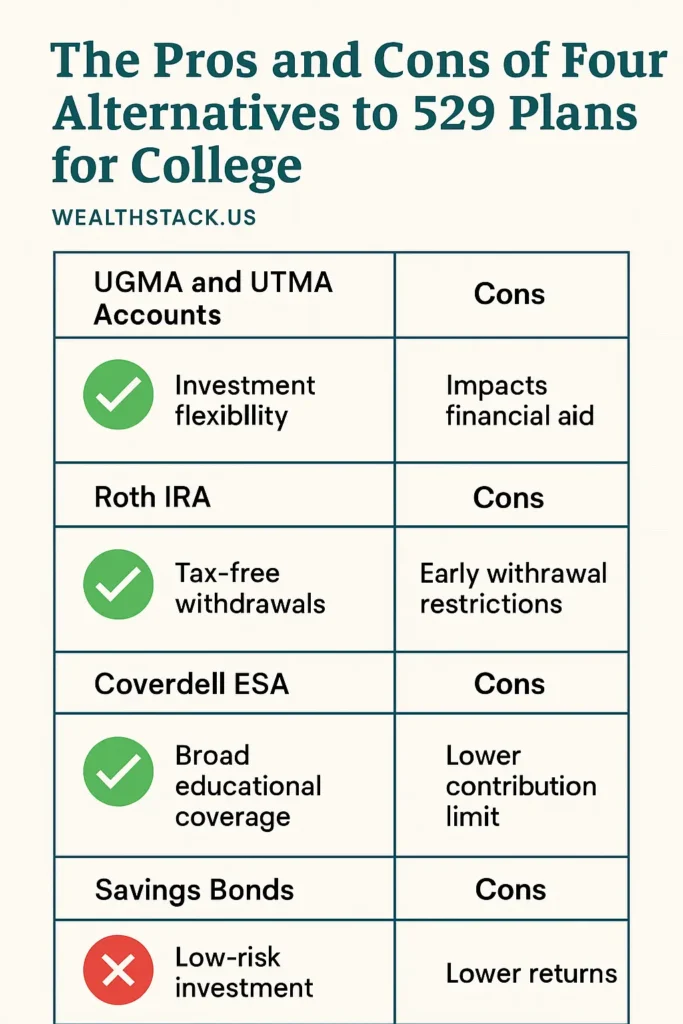

The Pros and Cons of Four Top Alternatives to 529 Plans for College

Based on popularity and effectiveness, here are the four most recommended alternatives:

1. Roth IRA

Pros: Dual purpose, tax advantages, financial aid friendly Cons: Contribution limits, income restrictions

2. UGMA/UTMA Accounts

Pros: Investment flexibility, no contribution limits Cons: Heavy financial aid impact, child gains control

3. Coverdell Education Savings Account

Pros: K-12 and college coverage, investment options Cons: Low contribution limits, income restrictions

4. Taxable Investment Accounts

Pros: Ultimate flexibility, no restrictions Cons: No tax advantages, taxable gains

Common Mistakes to Avoid When Choosing Alternatives

- Ignoring financial aid impact: Some alternatives significantly reduce aid eligibility

- Focusing only on taxes: Tax benefits don’t always outweigh other factors

- Not considering timeline: Your investment horizon should influence your choice

- Overlooking fees: Some alternatives have high costs that reduce returns

- Putting all eggs in one basket: Consider using multiple strategies

What About “Best 529 Plans by State” & “Compare 529 Plans”?

Even if you go with a 529, it’s smart to compare options. Many websites publish best 529 plans by state (based on fees, investment choices, state tax incentives). savingforcollege.com+2529wi.voya.com+2

To compare 529 plans, look at:

- Fees (management, administrative)

- Investment options

- State tax benefits (if your state offers deductions or credits)

- Portability (can you use it out-of-state?)

- Past performance

Even NerdWallet publishes guides around “Best 529 plans NerdWallet” comparing plans by cost, return, etc.

Addressing “Why 529 Plans Are a Bad Idea”

There are situations when 529 plans might be less ideal. Some common criticisms include:

- If the child doesn’t go to college, you may pay penalties or taxes to withdraw for non-qualified uses.

- Limited investment choices and, in some plans, high fees.

- The plan might influence financial aid eligibility.

- Some states offer weak benefits or none.

But many of these drawbacks are manageable — and in many cases, 529 plans are still a solid core of a college savings strategy.

Take Action: Your Next Steps

- Calculate college costs: Use online calculators to estimate future education expenses

- Assess your financial aid likelihood: Use FAFSA estimators to understand potential aid

- Start small: You can always adjust your strategy as circumstances change

- Compare options: Consider 2-3 alternatives that match your priorities

- Consult a professional: For complex situations, consider speaking with a financial advisor

Frequently Asked Questions

Q: Are Vanguard 529 plans better than these alternatives?

A: Vanguard offers excellent 529 plans with low fees, but alternatives may be better depending on your need for flexibility, financial aid considerations, and investment preferences.

Q: What do NerdWallet and other experts recommend?

A: Most experts, including NerdWallet’s best 529 plans analysis, suggest starting with 529 plans but acknowledge alternatives can be superior for specific situations.

Q: Can I use multiple strategies together?

A: Absolutely! Many families combine 529 plans with Roth IRAs or other alternatives to maximize benefits.

Q: How do state 529 plans compare to these alternatives?

A: The best 529 plans by state offer local tax deductions, but alternatives might provide better overall value depending on your situation.

Final Thoughts & Strategy: Smart College Savings Goes Beyond 529s

While 529 plans work well for many families, the best 529 plan alternatives for smarter college savings might better serve your unique situation. Whether you choose a Roth IRA for dual-purpose planning, UGMA accounts for investment flexibility, or Coverdell ESAs for K-12 and college coverage, the key is starting early and staying consistent.

- There’s no one “best” option for everyone.

- The best 529 plan alternatives for smarter college savings depend on your income, risk tolerance, goals, and family circumstances.

- In many cases, combining a 529 with a Roth IRA or brokerage account gives you balance: tax benefits plus flexibility.

- Always check state-specific rules (especially for 529s and ESA).

- Use reputable comparison tools (e.g. from NerdWallet, SavingForCollege) to weigh plans.

- And if things change (your child chooses a trade school, or doesn’t go to college), many of these alternative accounts let you adjust without severe penalties.

Remember, there’s no one-size-fits-all approach to college savings. The best strategy is the one you’ll actually stick with and fund consistently over time. Consider your family’s specific needs, financial situation, and goals when making this important decision.

Ready to start saving smarter for college? Compare these alternatives with your current 529 plan or start fresh with the option that best fits your family’s needs.

References

- Understanding Fed Rate Cuts 2025 and Their Impact on Financial Strategies

- The Complete Guide to the Ink Business Cash Credit Card: Everything You Need to Know

- What Happens to Student Loans When You Die?

- Mortgage Rates today

- Mastering the Art of Disputing a Medical Bill

- Understanding Student Loan Interest Deduction and Other Tax Breaks for Education in the USA